Bradley University Communications sent out an email on March 9 to all students and parents listed, notifying that the 2018 year’s Form 1098-T included a miscalculated field in box one.

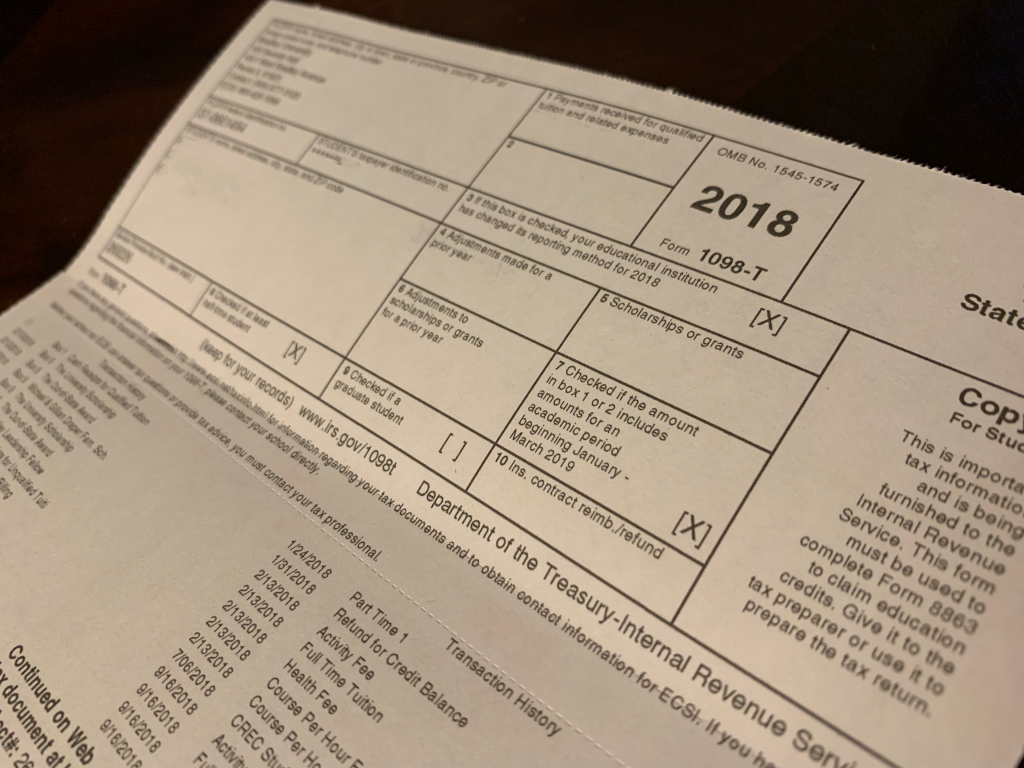

The Form 1098-T is a tuition statement that colleges and universities are required to provide all enrolled students who made a tuition payment each calendar year per the Internal Revenue Service. However, the form is used for supporting documentation and not required to receive education credit.

Ryan Schmidgall, assistant controller and tax director, said the error was due to a change of IRS requirement that states box one must reflect cash receipts instead of the billed amount.

“The IRS changed [its] reporting requirements effective for calendar year 2018 where you had to start reporting on the cash receipts themselves rather than the amounts you bill,” Schmidgall said. “That’s essentially where our error came into play.”

Some students and parents might need to adjust the amount reported education deduction credit if they have finished their taxes.

“The only way it would affect the students and parents is if they have already filed their taxes and might need to go in and amend,” Schmidgall said.

According to Schmidgall, this change was recognized and the office began altering what they were doing back in March 2018 with tests. The samples taken did not show any errors.

“We were aware of the change and we were taking steps to address the change and we thought we had everything correct in our logic and it turns out those 2019 payments were getting set aside,” Schmidgall said.

Schmidgall said the error mostly affects students who paid their 2019 spring semester tuition and other fees before the end of the 2018 calendar year.

“We recently discovered that our box one number was lacking some of the spring 2019 [payments],” Schmidgall said. “Those cash payments that had been made in November and December weren’t being reflected in the box one calculation.”

The error affects the January term, the online graduate nursing program and the 2019 spring semester that were all billed in November.

The miscalculation is not related to scholarships or loans because these are typically dispersed the first day of the semester.

Schmidgall said they noticed the payments were not being reported correctly after a parent called questioning about the amounts that were reported in box one.

“After we looked into their question … that’s when we noticed that it wasn’t picking up that payment for the spring 2019 semester,” Schmidgall said. “So we started looking at other students and noticed that it wasn’t just the one student. It was all of those November [and] December 2018, for spring 2019, payments that weren’t being picked up.”

For students that signed up to receive the electronic version of the form, the new form will be available on Educational Computer Systems, Inc. (ECSI) once the file is uploaded. Those students who did not opt-in to the electronic version will be mailed an updated Form 1098-T.

“We’re getting a new form, so that we can look at it and upload it to ECSI to include those payments made at the end of the calendar year for the spring 2019 semester,” Schmidgall said.

Form 1098-T should not be the only document students and parents rely on to fill out Form 8863, which is used to receive education credit on tax returns, as the purpose of the form does not reflect all eligible credits, such as textbook purchases.

“There’s other expenses that you can claim as an educational credit outside of the 1098-T,” Schmidgall said. “Bradley doesn’t have its own bookstore, so anything that you would pay for books and supplies at the bookstore, you can consider an educational expense and claim that on your 8863.”

The error does not affect students’ billing statements from the university.

“The cash receipts themselves are posted on the students’ account for 2018 on the date that we received them,” Schmidgall said. “It’s just a matter of how the form, how it was calculating box one.”