College is expensive, and the means of paying for college through student loans can be a stressful and confusing process, leaving many students wondering where their money is going. Hopefully, this guide helps alleviate some of those uncertainties.

Types of loans

There are two types of loans students can bring to Bradley: federal and private. Under the federal loans category are direct subsidized loans, which are based on financial need, and direct unsubsidized loans, which are not.

For graduate students or parents of dependent undergraduate students, the U.S. Department of Education offers PLUS loans. These help pay for expenses not covered by other financial aid.

Private student loans are not funded by the government, but rather, from banks, credit unions and other types of lenders. The repayment process is unique to each private loan.

According to Dave Pardieck, associate director of Enrollment Management and director of Financial Assistance, Bradley brings in $40 million in federal loans each year and $8 to $10 million in private loans each year.

Interest Rates

If students take out a federal loan, they will have to repay it and any interest it accrued. According to studentloans.gov, interest rates range from 4.29 percent for direct subsidized loans and unsubsidized loans for undergraduate students to 5.84 percent for direct unsubsidized loans for graduate students and 6.84 percent for direct PLUS loans for parents and graduate students.

The federal government pays interest rates on subsidized loans while the student is completing undergraduate studies or if they are in a difficult economic situation after graduation. On the other hand, students are required to pay all interest rates on unsubsidized loans regardless of the situation.

Interest rates on private loans vary from lender to lender.

Repaying loans

There are a few important points to remember when paying loans off, according to Pardieck.

“Borrow only what you need,” he said. “There are limits on what you can borrow on an annual basis, and you don’t want to overspend. This will ultimately allow you to manage your debt appropriately.”

Pardieck also stressed the importance of communication. He said it is vital to understand the terms and conditions you are agreeing to, such as knowing when your loan goes into repayment. Any information that is sent to students is important.

When to repay loans

There are several different plans to choose when applying for a federal student loan. All federal loans, except for the PLUS loan, have a six-month grace period. This gives students time to become financially settled before payments begin.

Payments are usually made monthly, and each bill will list the type of loan taken out, how much money was borrowed, the interest rate on the loan and the different types of repayment plans chosen.

For more information about loans, students can reach out to the Office of Financial Assistance located in room 100 of Swords Hall or emailing bufinaid@bradley.edu.

What do Bradley students think?

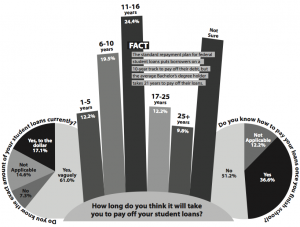

A survey was releassed to Bradley students by The Scout Oct. 22 on social media and in Hilltop Happenings, focusing on questions about how much students know about their student loans.

The graph results are taken from the survey, which included a 41 student pool.

The fact portion is according to U.S. News and World Report.